The structured settlement industry represents one of the most lucrative opportunities in financial content marketing, with keywords commanding premium CPCs ranging from $94 to $320 per click. This comprehensive guide reveals the essential information about structured settlement loans that millions of Americans need to know.

Understanding Structured Settlements: The Foundation of Financial Security

Structured settlements have become a cornerstone of personal injury and legal compensation, providing guaranteed income streams for individuals who have suffered significant damages. These financial arrangements offer periodic payments over time rather than a single lump sum, creating long-term financial stability for recipients.

A structured settlement is essentially a financial arrangement where compensation from a legal settlement is paid out through scheduled payments over an extended period. This system is typically funded through annuities purchased by the defendant’s insurance company, ensuring that recipients receive consistent income for years or even decades.

The popularity of structured settlements has grown dramatically, with the industry now processing billions of dollars in settlements annually. Recipients often include individuals who have experienced personal injuries, wrongful death cases, workers’ compensation claims, and other significant legal matters requiring substantial compensation.

The Truth About Structured Settlement Loans: What Companies Don’t Want You to Know

Despite aggressive marketing campaigns featuring memorable slogans like “It’s my money and I need it now,” the reality about structured settlement loans is far more complex than advertisements suggest. The fundamental truth that many companies obscure is that structured settlement loans don’t actually exist.

What companies advertise as “structured settlement loans” are actually factoring transactions – a completely different financial arrangement. In a factoring transaction, you’re not borrowing money against your future payments; you’re selling all or a portion of your future structured settlement payments to a company at a significantly reduced rate.

True Cost of Structured Settlement Factoring: What You Actually Receive vs. What You Give Up

Why True Structured Settlement Loans Are Impossible

Several critical factors prevent structured settlements from being used as collateral for traditional loans:

- No Physical Collateral: Banks cannot seize a structured settlement if you default on a loan, as there are no tangible assets to recover

- Legal Transfer Requirements: Structured settlements require court approval for any transfer, making them unsuitable as loan collateral

- Tax-Free Status: The tax-free nature of structured settlements prevents their transfer to for-profit lending institutions

- Regulatory Restrictions: State Structured Settlement Protection Acts (SSPAs) mandate court approval for any transfer of payments

The Factoring Process: How Structured Settlement Sales Actually Work

When you see advertisements for “structured settlement loans,” companies are actually offering to purchase your future payments through a factoring process. This transaction involves several key steps and considerations:

Step 1: Initial Consultation and Quote

Companies typically offer free consultations to evaluate your structured settlement and provide initial quotes. During this phase, they’ll assess the total value of your remaining payments, your financial needs, and the legal requirements in your state.

Step 2: Partial vs. Complete Sale Decision

You can choose to sell either all of your future payments or just a portion of them. This flexibility allows you to maintain some ongoing income while accessing immediate cash for urgent needs.

Step 3: Court Approval Process

All structured settlement transfers require court approval under state SSPAs. This legal requirement exists to protect settlement recipients from making decisions that might not serve their best interests.

Step 4: Legal and Administrative Costs

The factoring process involves significant legal fees and administrative costs, which are typically deducted from your settlement proceeds. These costs can range from several hundred to several thousand dollars.

Financial Implications: Understanding the True Cost

The decision to sell structured settlement payments carries substantial financial implications that extend far beyond the immediate cash received. Understanding these costs is crucial for making informed decisions about your financial future.

Discount Rates and Present Value

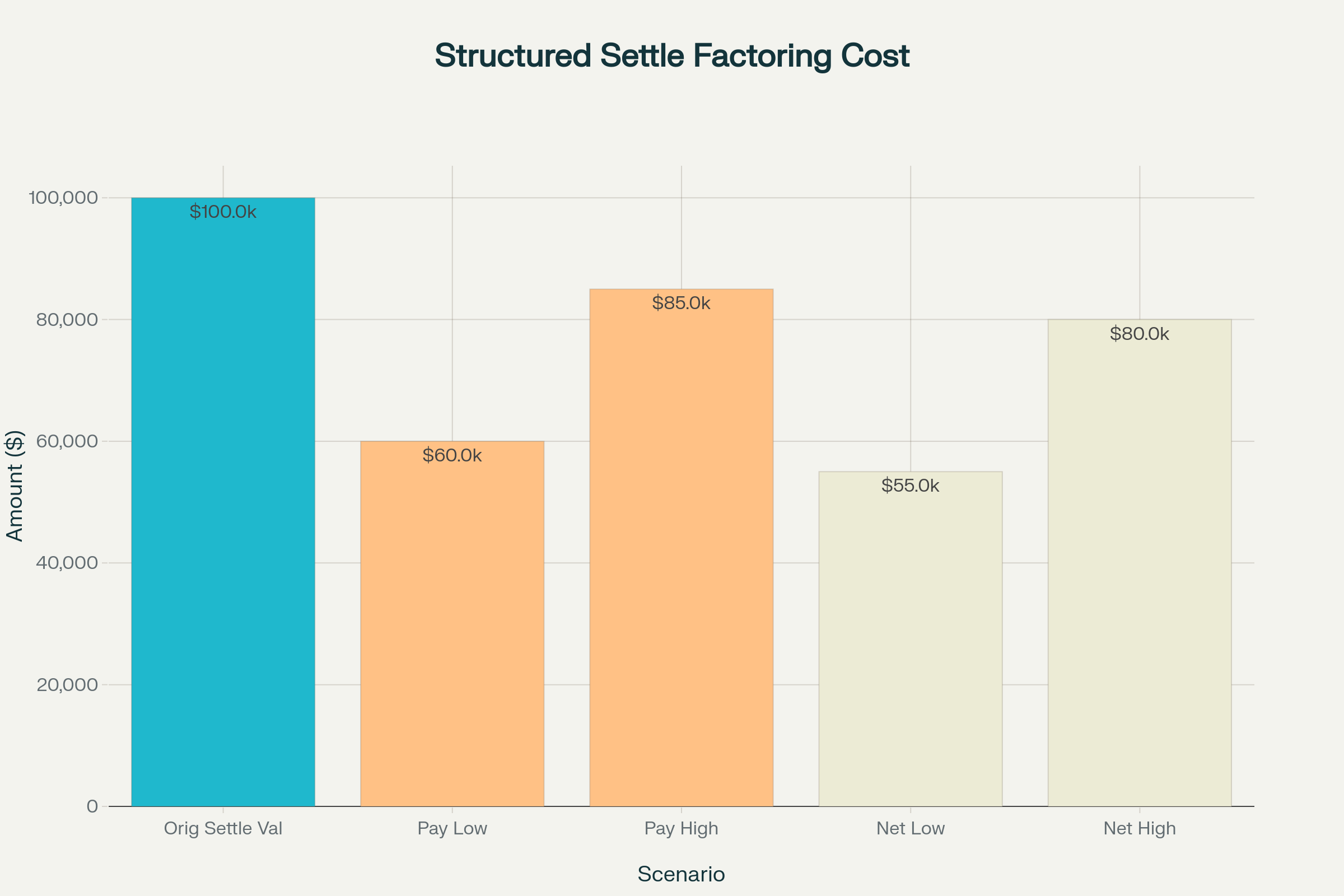

Factoring companies purchase structured settlements at significant discounts to their face value. The discount rate – the percentage reduction from the total payment value – can range from 15% to 40% or more, depending on various factors.

For example, if you have $100,000 in remaining structured settlement payments, you might receive only $60,000 to $85,000 in cash, depending on the discount rate applied. This represents a substantial cost for accessing your money early.

Factors Affecting Discount Rates

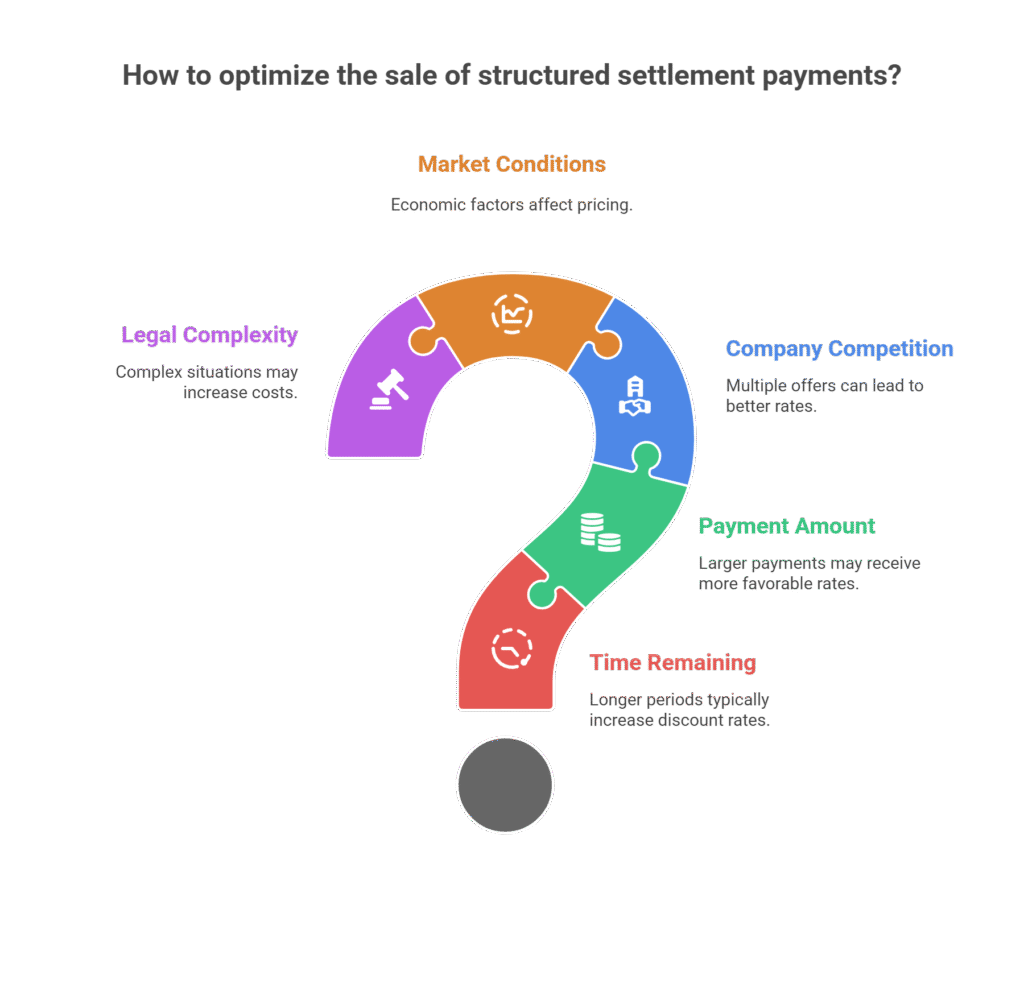

Several factors influence the discount rate applied to your structured settlement sale:

- Time Remaining: Longer payment periods typically result in higher discount rates

- Payment Amount: Larger individual payments may receive more favorable rates

- Company Competition: Multiple competing offers can result in better rates

- Market Conditions: Economic factors and interest rates affect pricing

- Legal Complexity: Complex legal situations may increase costs

Opportunity Cost Analysis

Beyond the immediate discount, selling structured settlement payments eliminates the guaranteed income stream that was designed to provide long-term financial security. This opportunity cost can be particularly significant for individuals with ongoing medical expenses or other long-term financial needs.

Legal Framework and Consumer Protection

The structured settlement industry operates under a comprehensive legal framework designed to protect consumers from predatory practices and ensure that transfer decisions serve their best interests.

State Structured Settlement Protection Acts

Every state has enacted SSPAs that establish specific requirements for structured settlement transfers. These laws typically require:

- Court Approval: All transfers must be approved by a judge

- Best Interest Standard: Courts must determine that the transfer serves the recipient’s best interests

- Disclosure Requirements: Companies must provide detailed information about costs and terms

- Waiting Periods: Mandatory waiting periods allow recipients to reconsider their decisions

- Independent Legal Advice: Some states require recipients to receive independent legal counsel

Consumer Rights and Protections

Recipients of structured settlements have specific rights protected by law:

- Right to Independent Legal Advice: Access to legal counsel independent of the factoring company

- Right to Full Disclosure: Complete information about all costs, fees, and terms

- Right to Withdraw: Ability to cancel the transaction within specified timeframes

- Right to Fair Treatment: Protection from deceptive or misleading practices

When Structured Settlement Sales Make Financial Sense

While structured settlement sales involve significant costs, certain circumstances may justify these transactions:

Medical Emergencies

Serious medical emergencies requiring immediate, expensive treatment that exceeds available insurance coverage may justify the cost of selling structured settlement payments.

Educational Opportunities

Investing in education or professional development that significantly increases earning potential may provide returns that justify the transaction costs.

Housing and Homeownership

Using structured settlement funds as a down payment on a home may provide long-term financial benefits, particularly in appreciating real estate markets.

Business Investment

Starting or expanding a business that generates sufficient returns to offset the discount rate may justify selling structured settlement payments.

Debt Consolidation

In cases where high-interest debt is consuming a significant portion of income, using structured settlement funds to eliminate debt may improve overall financial health.

Alternatives to Structured Settlement Sales

Before deciding to sell structured settlement payments, recipients should explore alternative options for accessing needed funds:

Traditional Lending Options

- Personal Loans: Unsecured loans based on creditworthiness and income

- Home Equity Loans: Loans secured by home equity for homeowners

- Credit Cards: For smaller amounts, though typically at higher interest rates

- Family Loans: Borrowing from family members or friends

Government and Community Resources

- Government Assistance Programs: Various federal and state programs provide financial assistance

- Community Organizations: Non-profit organizations often provide emergency financial assistance

- Religious Organizations: Faith-based groups frequently offer financial support to members

- Charitable Organizations: Various charities provide assistance for specific needs

Financial Planning and Budgeting

Working with a financial advisor to develop a comprehensive budget and financial plan may identify ways to meet financial needs without selling structured settlement payments.

Choosing the Right Factoring Company

If you decide that selling structured settlement payments is the best option, selecting the right factoring company is crucial for protecting your interests.

Key Selection Criteria

When evaluating factoring companies, consider these important factors:

- Industry Experience: Companies with extensive experience in structured settlement transfers

- Financial Stability: Well-established companies with strong financial backing

- Transparent Pricing: Clear, upfront disclosure of all costs and fees

- Customer Service: Responsive, helpful customer service throughout the process

- Legal Compliance: Full compliance with all applicable state and federal regulations

Red Flags to Avoid

Be wary of companies that exhibit these warning signs:

- High-Pressure Sales Tactics: Pushing for immediate decisions without adequate time for consideration

- Lack of Transparency: Refusing to provide clear information about costs and terms

- Unrealistic Promises: Offering terms that seem too good to be true

- Poor Reviews: Consistently negative reviews from previous customers

- Regulatory Issues: Companies with regulatory violations or legal problems

The Application and Approval Process

Understanding the structured settlement transfer process helps ensure smoother transactions and better outcomes.

Initial Application

The process begins with a detailed application that includes:

- Personal Information: Basic demographic and contact information

- Settlement Details: Complete information about the structured settlement

- Financial Information: Current financial situation and needs

- Legal Documentation: Copies of settlement agreements and court orders

Company Evaluation

Factoring companies evaluate applications based on several factors:

- Payment Schedule: Timing and amount of future payments

- Legal Complexity: Any legal issues that might complicate the transfer

- Court Jurisdiction: The state and court system where approval is required

- Recipient Circumstances: Overall financial situation and needs

Court Approval Process

The court approval process involves several steps:

- Petition Filing: The factoring company files a petition with the appropriate court

- Notice Requirements: Interested parties must be notified of the proposed transfer

- Court Hearing: A hearing where the judge evaluates the proposed transfer

- Judicial Review: The judge determines whether the transfer serves the recipient’s best interests

- Final Order: If approved, the court issues an order authorizing the transfer

Industry Trends and Future Outlook

The structured settlement industry continues to evolve, with several trends shaping its future.

Regulatory Evolution

Ongoing regulatory changes aim to provide greater consumer protection and transparency in structured settlement transactions.

Technology Integration

New technologies are streamlining the application and approval process while improving transparency and efficiency.

Market Competition

Increased competition among factoring companies is leading to better rates and terms for consumers.

Consumer Education

Growing awareness of structured settlement options and consumer rights is leading to more informed decision-making.

Making the Right Decision for Your Financial Future

The decision to sell structured settlement payments is one of the most important financial decisions you may ever make. It requires careful consideration of your immediate needs, long-term financial goals, and available alternatives.

Key Decision Factors

When evaluating whether to sell structured settlement payments, consider:

- Urgency of Need: Whether your financial need is truly urgent and cannot be met through other means

- Cost of Capital: The total cost of accessing your money early compared to alternative financing

- Long-Term Impact: How the sale will affect your long-term financial security

- Alternative Options: Whether other financing options might be more suitable

- Professional Advice: Input from financial advisors, attorneys, and other professionals

Professional Guidance

Before making any decision about structured settlement sales, consult with qualified professionals who can provide objective advice about your specific situation.

The structured settlement industry offers both opportunities and risks. While these transactions can provide needed cash for urgent situations, they come with significant costs and long-term implications. Understanding these factors, exploring alternatives, and seeking professional guidance are essential steps in making decisions that serve your best interests and protect your financial future.

By staying informed about your rights, understanding the true costs involved, and carefully evaluating your options, you can make decisions that align with your financial goals and provide the security you need for the future. Remember that the money from your structured settlement was designed to provide long-term financial protection – any decision to alter those payments should be made with careful consideration of the long-term consequences.