Are you ready to ride the wave of India’s IPO revolution? With over ₹1.4 lakh crore worth of upcoming offerings in the pipeline and retail investors earning an average 47% returns in 2024, the fear of missing out on the next big wealth creator is real. This comprehensive guide reveals everything you need to know about India’s most promising upcoming IPOs and how to position yourself for potential multibagger returns.

Indian retail investors display excitement while viewing market activity on a computer screen

India’s IPO market is experiencing an unprecedented boom that’s creating millionaires overnight. While your friends and colleagues are already booking profits from recent blockbuster listings, the question isn’t whether you should invest – it’s which upcoming IPOs deserve your attention before everyone else discovers them.

The IPO Gold Rush: By the Numbers

India’s primary market has transformed into a wealth-generation machine that’s impossible to ignore. The statistics tell a compelling story that every smart investor needs to understand.

India’s IPO Market Growth: Number of IPOs and Funds Raised (2022-2025 Q1)

The data reveals a market in hypergrowth mode. From a modest 47 IPOs raising $3.2 billion in 2022, we’ve witnessed an explosive expansion to 338 IPOs mobilizing nearly $21 billion in 2024. This represents a 556% increase in funding and a 619% surge in IPO count – numbers that scream opportunity for those ready to act.

Current Market Momentum:

- ₹1.4 lakh crore pipeline of approved IPOs awaiting launch

- 72 companies already have SEBI clearance

- July 2025 alone targets ₹20,565 crore in new offerings

- Average listing gains of 47% in 2024

The Retail Revolution: Why This Time Is Different

Something extraordinary is happening in India’s investment landscape. Retail investors are no longer spectators – they’re driving the market.

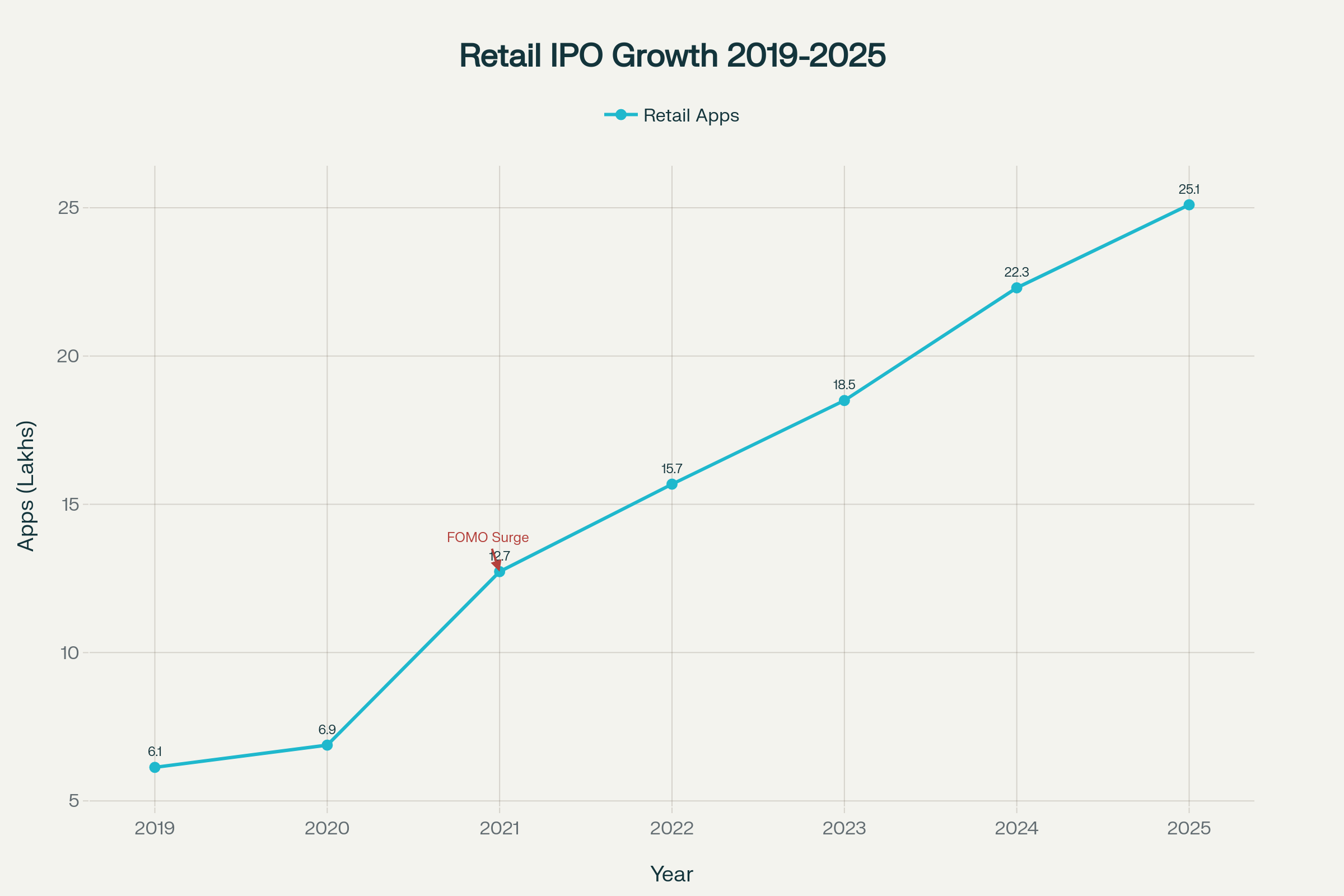

The Rise of Retail Investors in India’s IPO Market: FOMO-Driven Growth (2019-2025)

The numbers are staggering: retail investor participation has skyrocketed from 6.13 lakh applications in 2019 to an estimated 25.1 lakh in 2025. More importantly, their market share has grown from 35% to 52%, giving individual investors unprecedented influence over IPO outcomes.

What’s Fueling This FOMO Frenzy:

- Digital-first platforms making IPO applications as easy as ordering food

- Social media success stories of overnight wealth creation

- Record-breaking oversubscriptions creating urgency and exclusivity

- Young investor dominance with 40.2% of investors now under 30

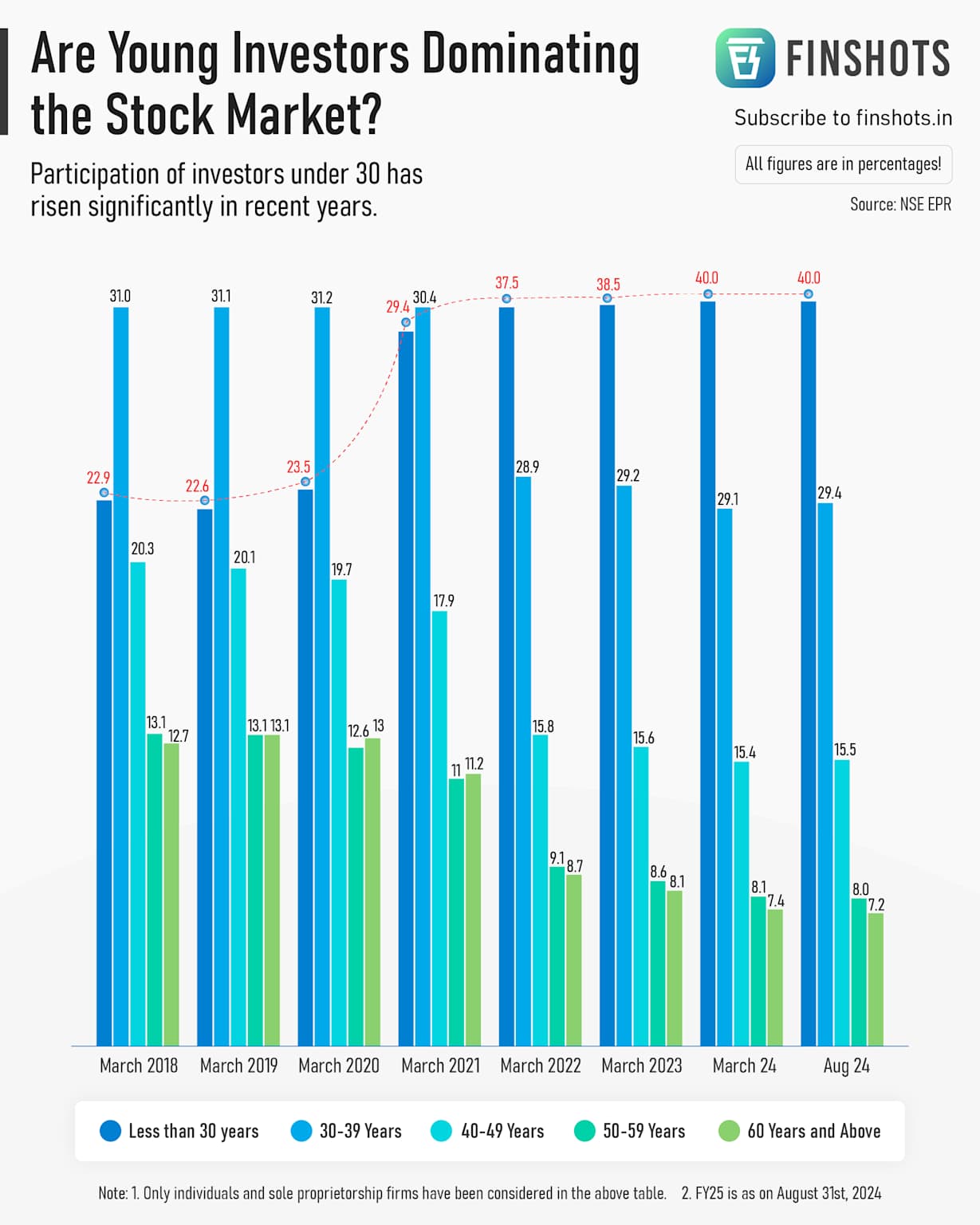

Participation of investors under 30 years has risen significantly from 22.9% in 2018 to 40% in 2024, showing young investors’ growing dominance in the stock market

Upcoming IPO Superstars: The Ones Everyone’s Talking About

The pipeline is loaded with household names and potential unicorns that could define the next wave of wealth creation. Here are the must-watch IPOs that have investors buzzing:

NSDL IPO: The Infrastructure Play

- Expected Launch: July 2025

- Issue Size: ₹3,424 crore

- Why It Matters: India’s largest depository with 31.46 million active demat accounts

- Competitive Edge: Monopolistic position in securities infrastructure

Tata Capital IPO: The Financial Heavyweight

- Expected Launch: August 2025

- Issue Size: ₹17,200 crore

- Current Valuation: ₹3.8 lakh crore in unlisted market

- Growth Story: 55.91% revenue growth in FY25

- Tata Brand Premium: Backed by India’s most trusted conglomerate

Zepto IPO: The Quick-Commerce Revolution

- Expected Timeline: Delayed to 2026

- Target Raise: $1 billion

- Current Valuation: $5 billion

- Growth Metrics: 120% revenue growth to ₹4,454 crore in FY24

Other Power Players in the Pipeline:

- HDB Financial Services: ₹12,500 crore offering

- Hero FinCorp: ₹3,668 crore automotive finance play

- Vikram Solar: ₹1,500 crore renewable energy opportunity

- JSW Cement: ₹4,024 crore infrastructure bet

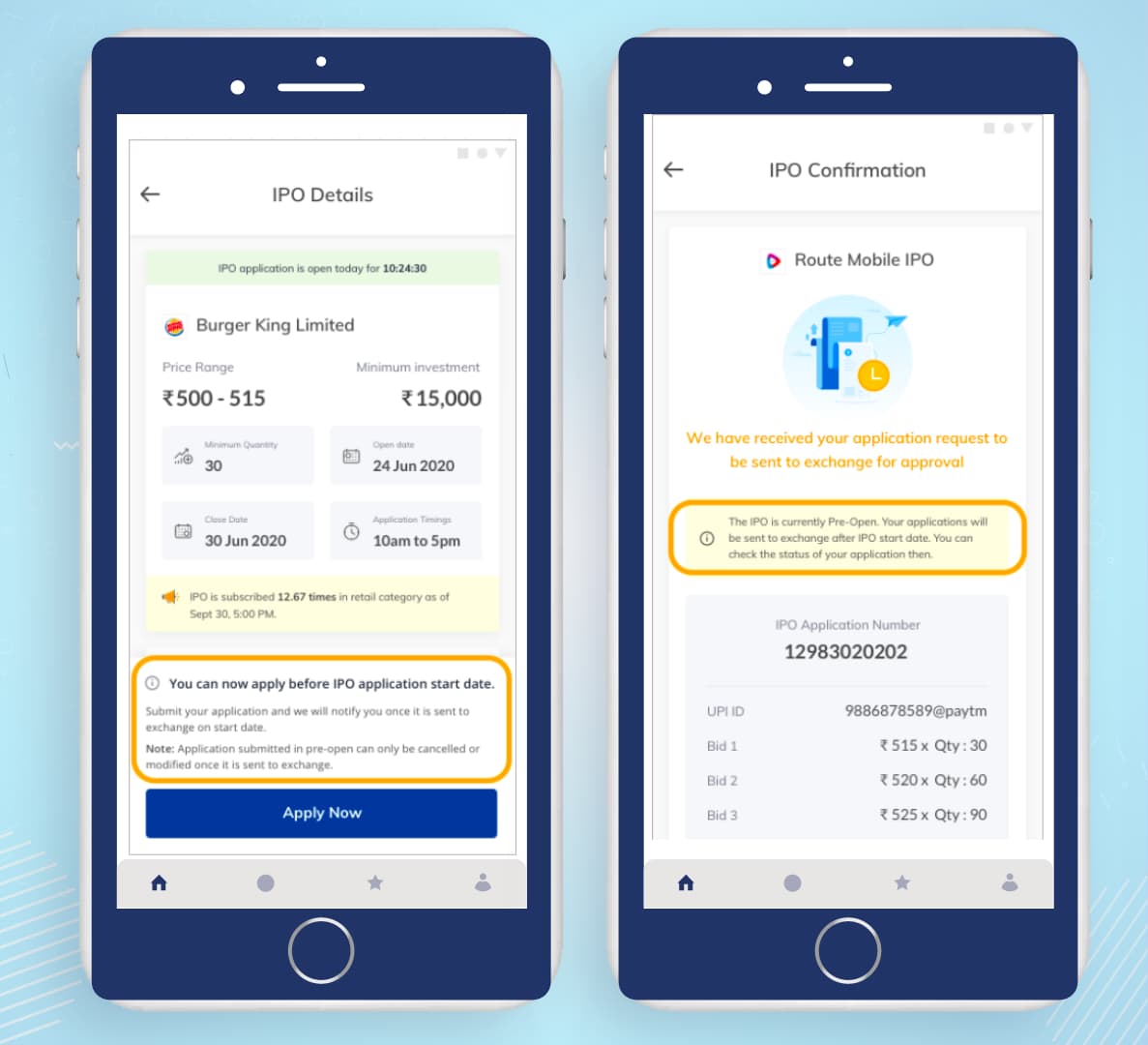

Mobile app interfaces showing IPO details and application confirmation for retail investors in India, highlighting subscription stats and pre-application features

The Multibagger Track Record: Why The FOMO Is Justified

Before you dismiss IPO investing as hype, consider the wealth creation that recent investors have experienced. The data doesn’t lie – and neither do the returns.

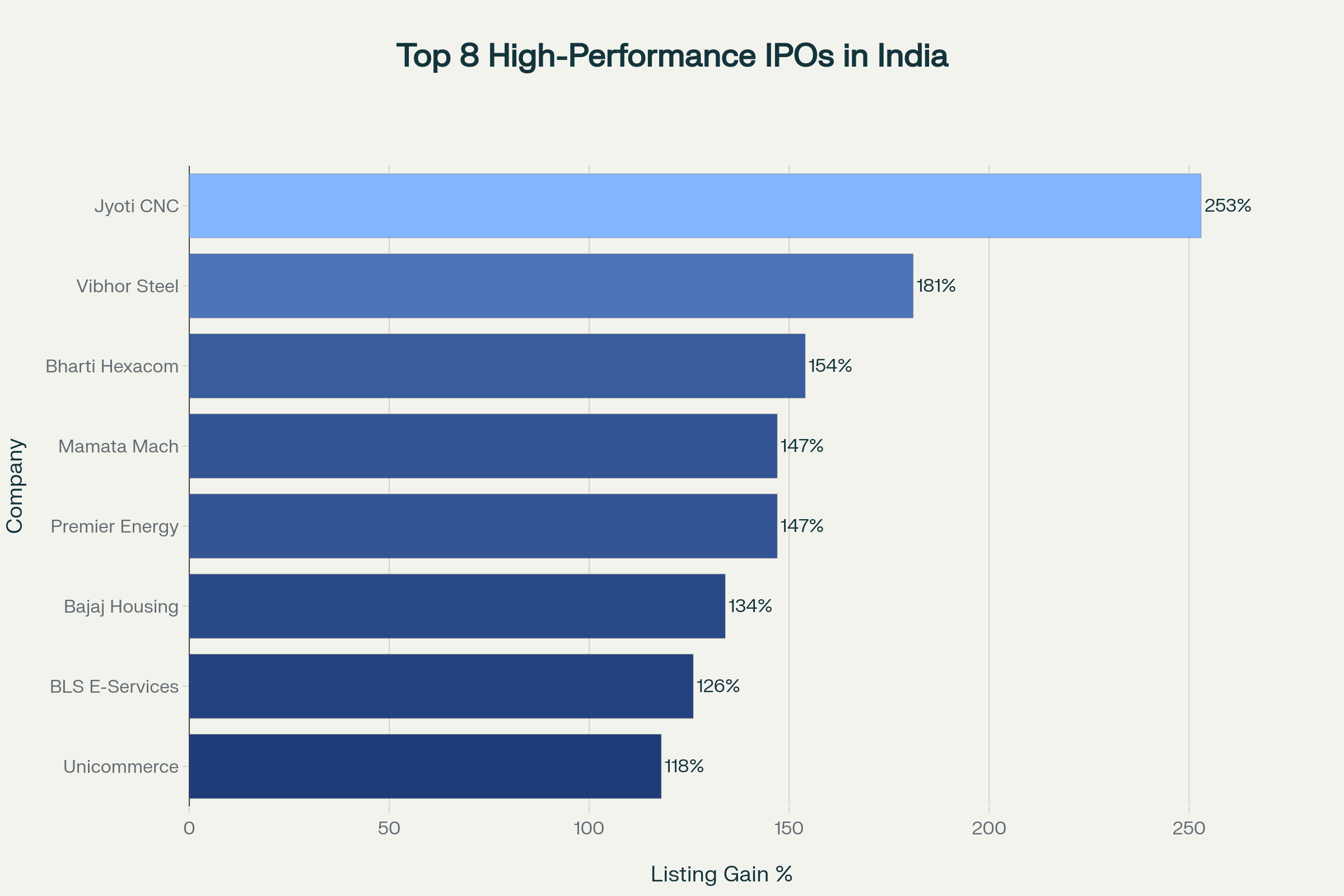

Top Performing IPOs in India 2024: Multibagger Returns That Created Investor Wealth

2024’s Biggest Winners:

- Jyoti CNC Automation: 253% listing gains

- Vibhor Steel Tubes: 181% first-day returns

- Bharti Hexacom: 154% listing premium

- Premier Energies: 147% opening gains

- Bajaj Housing Finance: 134% listing day surge

These aren’t outliers – they represent a systematic opportunity for informed investors. With an 80% success rate of IPOs delivering positive listing gains in 2024, the odds are stacked in favor of prepared investors.

The Oversubscription Effect:

Recent data shows that highly oversubscribed IPOs (50x-100x range) deliver the best risk-reward balance. When retail and institutional investors compete aggressively for shares, it typically signals strong fundamentals and pricing power.

Smart Money Strategies: How to Position for Maximum Returns

Success in IPO investing isn’t about luck – it’s about systematic approaches that maximize your allocation chances and optimize returns.

The Allocation Game Plan

For Retail Investors (Up to ₹2 lakh investment):

- Apply at cut-off price for maximum allocation chances

- Use multiple family accounts to increase allocation probability

- Target 1 lot applications in oversubscribed issues for guaranteed minimum allocation

- No lock-in period means immediate liquidity post-listing

The FOMO Timing Strategy

Early Bird Advantage:

- Monitor grey market premiums as leading indicators

- Track institutional interest during anchor rounds

- Apply on Day 1 for trending IPOs to secure application priority

- Follow social media sentiment and influencer discussions for momentum plays

Portfolio Allocation Framework

Conservative Approach (Beginners):

- 10-15% of investment capital in IPO opportunities

- Focus on established companies with proven business models

- Diversify across 3-4 sectors to reduce concentration risk

Aggressive Growth Strategy:

- 20-30% allocation for experienced investors

- Include SME IPOs for higher return potential

- Use systematic application approach across all major upcoming issues

Risk Management: The Smart Investor’s Shield

While the FOMO is real, smart money always hedges its bets. Understanding risks ensures you profit from opportunities without losing your shirt.

The Reality Check

Despite the success stories, median IPO returns (5.9%) actually underperform Nifty 50 (12.8%) and Nifty 500 (14.8%) over longer periods. This means selectivity and timing are crucial for outperformance.

Key Risk Factors:

- Overvaluation in hot market conditions

- Lock-up expiry pressure from pre-IPO investors

- Market volatility affecting post-listing performance

- Sector rotation impacting thematic plays

Red Flags to Avoid

Warning Signs:

- Excessive grey market premiums (>100%) without strong fundamentals

- High debt-to-equity ratios in cyclical businesses

- Promoter dilution exceeding 75% of holdings

- Declining profit margins despite revenue growth

Illustration showing the concept of FOMO in investing and the risks of chasing stock market gains impulsively

The Technology Edge: How Digital Platforms Are Democratizing Wealth

The IPO application process has been revolutionized, making participation more accessible than ever. This technological shift is a key driver of the retail investor boom.

Digital Advantages:

- UPI-based applications eliminate payment hassles

- Real-time subscription data helps timing decisions

- Mobile-first platforms enable instant applications

- AI-powered research tools democratize fundamental analysis

Popular Platforms Driving Participation:

- Traditional brokers offering zero-fee IPO applications

- Fintech apps with simplified user interfaces

- Robo-advisors providing IPO recommendations

Market Timing: The ₹20,565 Crore July Opportunity

July 2025 is shaping up as the biggest IPO month since December 2024, with projected fundraising of ₹20,565 crore. This concentration of offerings creates a unique window of opportunity for investors.

Why July Matters:

- Market confidence has stabilized after Q1 volatility

- Institutional liquidity is at seasonal highs

- Retail enthusiasm peaks during summer trading season

- Global economic uncertainty has diminished

Strategic Positioning:

Smart investors should prepare early by:

- Building IPO application capacity across platforms

- Researching fundamentals of confirmed July launches

- Monitoring grey market trends for pricing insights

- Allocating capital for multiple simultaneous opportunities

Sector Spotlight: Where the Smart Money Is Flowing

Not all sectors are created equal in the current IPO cycle. Understanding thematic trends helps identify the highest-probability opportunities.

Financial Services: The Undisputed Leader

- Largest pipeline with Tata Capital, HDB Financial leading

- Regulatory tailwinds from RBI’s upper-layer NBFC requirements

- Digital transformation driving growth in fintech players

Technology & E-commerce: The Growth Engines

- Zepto’s delayed entry creating anticipation

- Quick-commerce revolution attracting premium valuations

- AI and automation themes gaining investor mindshare

Infrastructure & Renewables: The Long-term Plays

- Government capex driving infrastructure demand

- Clean energy transition supporting solar and wind companies

- ESG investing increasing institutional allocations

The Psychological Game: Mastering IPO FOMO

Understanding the behavioral aspects of IPO investing is crucial for long-term success. The fear of missing out can be both your greatest asset and biggest liability.

Positive FOMO Behaviors:

- Early research and preparation

- Quick decision-making when opportunities arise

- Network effects learning from successful investors

- Urgency-driven action preventing procrastination

Destructive FOMO Patterns:

- Panic buying at peak valuations

- Overleverage to maximize positions

- Neglecting due diligence in favor of speed

- Emotional decision-making based on social pressure

The Balanced Approach:

Channel your FOMO into systematic preparation rather than impulsive action. The biggest winners in IPO investing are those who combine emotional urgency with analytical discipline.

Global Context: India’s Rising IPO Dominance

India’s IPO market isn’t just growing – it’s dominating globally. Understanding this macro trend reinforces the long-term opportunity for Indian investors.

Global Rankings:

- Second-largest IPO market globally in 2024

- 12% of global IPO proceeds originated from India

- NSE ranked #1 globally by funds raised through IPOs

This international recognition attracts foreign institutional investment, creating additional demand for Indian IPOs and supporting higher valuations.

Action Plan: Your IPO Investment Roadmap

Immediate Steps (Next 30 Days):

- Open multiple demat accounts to maximize allocation chances

- Research upcoming July launches starting with NSDL and major offerings

- Set up UPI-based IPO application systems

- Follow grey market trends and institutional investor sentiment

- Build IPO investment capital separate from long-term holdings

Medium-term Strategy (3-6 Months):

- Develop sector expertise in 2-3 high-opportunity areas

- Track management presentations and roadshows

- Build network with other IPO investors for intelligence sharing

- Monitor regulatory changes affecting IPO markets

- Refine allocation strategy based on early results

Long-term Wealth Building (1-3 Years):

- Create systematic IPO portfolio with regular investments

- Develop exit strategies for different holding periods

- Reinvest gains into promising secondary market opportunities

- Build expertise in fundamental analysis and valuation

- Mentor others and benefit from network effects

The Bottom Line: Why Waiting Costs Money

Every day you delay is another day closer to missing the next Jyoti CNC Automation or Bajaj Housing Finance. With 143 IPOs worth ₹2.22 lakh crore currently in the pipeline and retail investor participation at all-time highs, the opportunity window is wide open – but it won’t stay that way forever.

The companies going public today are India’s tomorrow’s blue chips. The retail investors getting allocated today are tomorrow’s wealth creators. The question isn’t whether India’s IPO boom will continue – it’s whether you’ll be positioned to benefit when it does.

Remember: In investing, timing beats perfection. While others are still researching and debating, the smart money is already preparing for the next wave. The FOMO you feel today could be the motivation that drives your financial freedom tomorrow.

Start your IPO journey now – because in the world of wealth creation, the biggest risk isn’t losing money, it’s missing the opportunity entirely.

This article is for educational purposes and not personalized investment advice. IPO investments carry market risks, and past performance doesn’t guarantee future results. Always consult with qualified financial advisors and read offer documents before investing.